5 Chinese Fragrance Brands to Watch

Inside the rise of a once-niche market attracting investment from global beauty giants.

China’s fragrance market is rapidly evolving from a niche category into one of the world’s most dynamic beauty sectors. Once an underdeveloped space—accounting for just 2.5% of global perfume sales a few years ago—it is now surging. In 2024, the market was valued at 20.7 billion RMB (approximately $2.9 billion) and is projected to reach 51.5 billion RMB (around $7.2 billion) by 2029, reflecting an impressive annual growth rate of 22.5%. This momentum is drawing global attention and investment, firmly positioning fragrance as a new frontier in China’s beauty boom.

Several forces are driving this ascent. Cultural shifts play a major role: young Chinese consumers now embrace fragrance as a form of personal expression and a lifestyle choice, whereas a generation ago, perfume was often seen as an unnecessary luxury—or even a “Western” habit. Today’s Gen Z and Millennials view scent as integral to their identity and mood, fueling demand for more individualistic and meaningful choices. This aligns with the rising guochao (国潮) movement, in which brands celebrating Chinese culture resonate strongly. Local fragrance houses incorporate traditional ingredients like lotus, bamboo, mugwort, and magnolia, drawing inspiration from Chinese art, literature, and nostalgia.

At the same time, Chinese consumers have become more discerning; they no longer gravitate toward luxury price tags alone but seek brands with compelling storytelling, craftsmanship, and authenticity. This shift has created space for domestic niche perfume brands that blend heritage with modernity, crafting unique olfactory narratives tailored to Chinese tastes—and they are soaring in popularity.

Despite their growing influence, many of these brands remain difficult to find internationally. Still, a few have caught my attention. Among them are the TikTok sensation To Summer, as well as the lesser-known but intriguing brands Documents and YILI Olfactory Art—each offering a fresh perspective on Chinese perfumery that I can’t wait to explore.

To Summer

Founded in 2018 in Beijing by Shen Li (a former fashion editor) and Huipu Liu (an e-commerce expert), To Summer (观夏) channels the serenity and symbolism of Eastern aesthetics into modern fragrance. The brand prides itself on plant-based scents that honor Chinese tradition and culture while feeling fresh and innovative for young consumers. Riding the guochao wave, To Summer infuses its products with Chinese art and historical references—whether through boutiques housed in heritage buildings or design motifs inspired by classical literature. This seamless blend of old and new makes Chinese culture both aspirational and accessible to a trend-conscious generation.

Initially, To Summer gained recognition for its home fragrances—elegant scented candles, diffusers, and incense that transform living spaces into poetry. Limited-edition collections tied to traditional festivals, such as Lunar New Year and Mid-Autumn, frequently sell out due to their nostalgic appeal and gift-worthy design. Building on this success, the brand expanded into personal perfumes, with several fragrances going viral on TikTok.

Though positioned as a niche luxury brand, To Summer is actually more accessible in price than many Western luxury fragrance houses. This “affordable niche” strategy has broad appeal among urban professionals who seek an upscale ambiance without paying foreign brand premiums. To Summer’s boutiques—11 and counting across major cities like Beijing, Shanghai, and Shenzhen—are integral to its allure. Each is a minimalist sanctuary, often housed in culturally significant architecture, designed to create an immersive sensory experience. This storytelling-driven approach has cemented To Summer’s reputation as a tastemaker in homegrown fragrance, embodying modern Chinese elegance: an East-meets-West aesthetic that is both chic and deeply rooted.

Founder Shen Li has described her vision as creating a 'roadmap for Eastern fragrance' on a global scale. That ambition caught the eye of global beauty giants: in early 2024, L’Oréal made a strategic minority investment in the brand. L’Oréal’s North Asia chief praised To Summer’s approach, emphasizing that Chinese perfumery is now one of the fastest-growing segments in the beauty industry. With L’Oréal’s backing, Shen Li aims to introduce “the essence of Eastern elegance and grace” to international markets—positioning To Summer as the global flagship of modern Chinese fragrance.

Documents

Founded in 2021 by Zhaoran Meng, former CEO of Nudake China—a cutting-edge dessert/art retail concept linked to Gentle Monster and Tamburins—Documents (闻献) is arguably China’s most avant-garde perfume house, fusing Zen philosophy with ultramodern design. The brand describes its aesthetic as “chánkù”—a blend of meditation-like tranquility (chán) and effortless cool (kù). This ethos is palpable in its flagship stores, which feel more like conceptual art galleries than perfume boutiques: dark, minimalist spaces punctuated by abstract sculptures and a contemplative mood. The influence of Meng’s tenure at Nudake is unmistakable.

Rooted in Chinese heritage, Documents elevates traditional ingredients—star anise, mugwort, yulan magnolia, walnut—into refined, avant-garde compositions. Its high-end eau de parfums ($120–$250) have gained a cult following, praised for blending “oriental aesthetics” with a contemporary twist. Standout scents include a sleek, smoky take on mugwort, an herb tied to traditional festivals, and yulan magnolia, a flower symbolizing purity, reimagined with warm woods for a unisex edge.

Often called “China’s most expensive perfume brand”, Documents operates like a high-art fragrance house, crafting thematic olfactory explorations of Chinese culture. Rather than traditional advertising, it thrives on WeChat essays, Weibo storytelling, and visually rich marketing, positioning itself as the go-to for those who find mainstream luxury too predictable.

Like To Summer, Meng envisions Documents competing on the global stage. Investors agree. In 2022, Cathay Capital and L’Oréal China led a Series A round ($1.4M), followed by a multi-million-dollar investment from luxury retailer Ushopal in 2023. Ushopal’s CEO noted that Documents is “one of the very few Chinese brands that can compete with global high-end houses” in artistry and vision.

With this backing, Documents is scaling up—expanding boutiques, widening distribution, and preparing for an international launch. Yet, Meng insists on staying true to its essence: “awakening sensory resonance among urbanites” and introducing the world to China’s modern scent culture.

Melt Season

Founded in 2020 in Shanghai by Lishi Ni under beauty startup Verse Group, Melt Season is a luxury fragrance brand that blends Eastern and Western influences with a philosophy of “flow”—life as a natural, evolving stream. Rather than relying on clichéd cultural symbols, the brand subtly weaves Chinese aesthetics into chic, cosmopolitan scents. Its name reflects this ethos: seasons melting into one another, mirroring the fusion of traditions. This harmonious outlook shapes everything from its serene, layered fragrances to its minimalist, beige-toned stores.

Launched via WeChat in 2021, Melt Season debuted with a capsule of poetic perfumes, inspired by evocative imagery—misty spring dawns, drizzle on ancient pavilions. Priced at $100–$200, it sits in the luxury niche. A standout, “Pearl” (珍珠少女), a luminous floral, became a bestseller, earning the nickname “oriental Chloe”. Now with six boutiques, including a Shanghai flagship, the brand has expanded into scented candles and body products, though personal fragrance remains its focus.

Melt Season’s philosophy of organic growth attracted Estée Lauder, which took a minority stake in late 2023—its first investment in a Chinese fragrance brand. The move aligned with Estée Lauder’s pivot toward niche fragrancein China’s shifting beauty market. With its support, Melt Season accelerated retail expansion and duty-free pop-ups.

Looking ahead, Ni envisions Melt Season as a bridge between East and West, introducing Chinese-inspired scents to a global audience in a way that feels modern, inclusive, and enduring—like the steady flow of seasons melting into one another.

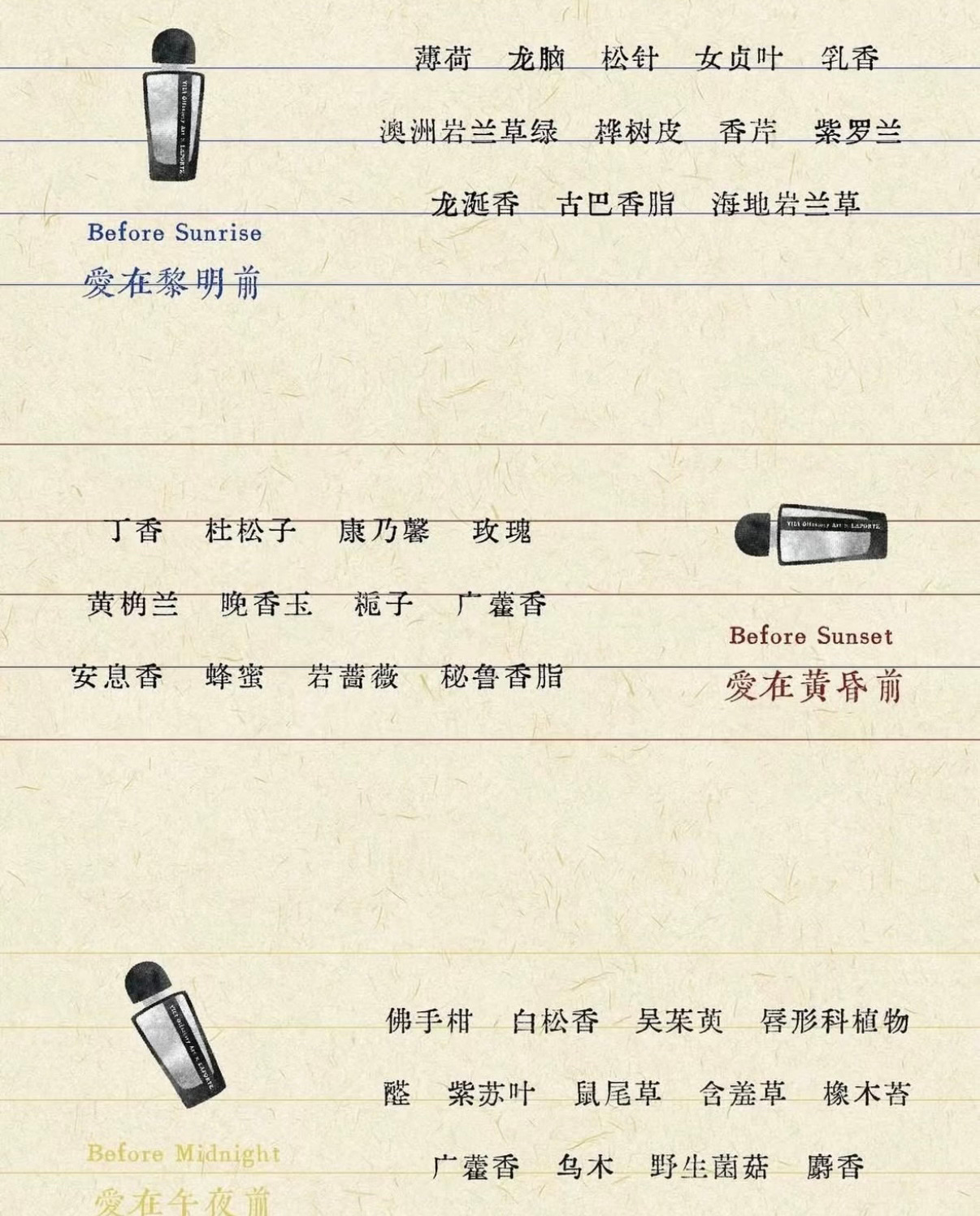

YILI Olfactory Art

Founded in 2018 in Beijing by perfumer Yili Li (known simply as “Yili”), YILI Olfactory Art operates more as an atelier than a commercial brand, dedicated to Chinese fragrance artistry. Yili’s workshop, nestled near Beijing’s 600-year-old Drum and Bell Tower, reflects his deep connection to history and culture. The brand follows a slow perfume philosophy—sourcing 90% organic materials, aging fragrances for a month before release, and packaging them in artisan-crafted bottles from Nice, France. This meticulous craftsmanship merges Chinese tradition with haute perfumery.

YILI Olfactory Art’s limited-edition perfumes have earned a cult following among scent connoisseurs. Standouts include “Witch,” “Hunter,” and “Pimp”, bold unisex scents recognized on Fragrantica, and “Wind Blows”, a 2023 Art and Olfaction Awards finalist. Yili’s signature is experimental storytelling, weaving unexpected notes like Sichuan pepper, raw honeycomb, and herbal tinctures to evoke mood and memory. One underground favorite, “Oldman”, a smoky tea-and-wood scent, became a hit in Beijing’s art circles, likened to a Chinese scholar’s study. Given the small-batch approach, with some releases priced at $300+ for 50ml, each perfume is more collectible than mass-market.

Unlike other luxury Chinese perfume brands, Yili’s edge lies in his personal authorship. As a trained perfumer, he crafts each formula himself, making every scent a direct reflection of China’s cultural landscape. His clientele is niche but devoted—perfume aficionados and art lovers who see YILI’s creations as wearable art. The brand is perceived as an olfactory artist’s studio—exclusive, avant-garde, and deeply rooted in local identity. While it lacks the commercial scale of bigger brands, its influence is undeniable, proving Chinese perfumery can compete globally on artistry and quality.

Beyond selling perfume, Yili is cultivating a fragrance ecosystem. He mentors young perfumers, provides raw materials, and fosters local talent. Unlike brands prioritizing aggressive expansion, his mission is to preserve storytelling and authenticity in Chinese perfumery. As the industry grows, Yili ensures it does so with artistic soul, respect for nature, and a reverence for heritage intact.

Scent Library

Founded in 2009 in Beijing by Roseline Lou and John Han, Scent Library (气味图书馆) pioneered Chinese fragrance nostalgia, bottling the everyday scents of Chinese life. At a time when perfume was rare in China, the brand asked, “What does childhood smell like?”—transforming local memories into fragrances. From the clean warmth of “chilled boiled water” (LBK) to the sweet creaminess of “Milk Candy”, Scent Library’s playful, evocative scents instantly transport consumers to cherished moments, offering a culturally rooted approach that foreign brands struggle to match.

Over the years, LBK (Liang Bai Kai) became the brand’s signature—a light, neutral fragrance inspired by the boiled water many Chinese grew up drinking. It was such a hit that it spun off into water-themed limited editions. Another standout, “Milk Candy”, captured the nostalgic White Rabbit candy aroma, expanding into body lotions and hand creams. The brand has also experimented with offbeat scents like “Snowy Tarmac” (fresh snow on pavement) and “Clothesline” (sun-dried laundry), reinforcing its museum-of-memories identity.

Positioned between niche fragrance and mass-market accessibility, Scent Library is affordable and widely available, with 80+ retail stores across China—from mall kiosks to stylish boutiques. By framing perfume as a comforting, stress-relieving experience rather than a luxury status symbol, it demystified fragrance for Chinese consumers. Its social media-driven, storytelling marketing turned scent into a fun, relatable part of daily life, making it a gateway brand for many first-time perfume wearers.

Recognizing its potential, Spanish luxury group Puig (owner of Penhaligon’s and L’Artisan Parfumeur) acquired a stake in 2021, leading a $10 million Series B round. Puig’s CEO called it “a rare opportunity to participate in China’s fragrance evolution with a homegrown brand.” The funding helped expand cultural product development, immersive retail experiences, and supply chain capabilities. Consumers welcomed the move, seeing it as a chance for higher quality and broader availability.

For founders Lou and Han, Scent Library remains rooted in its original vision: capturing China’s sensory heritage and making fragrance a familiar, everyday pleasure. As Lou noted, China’s perfume market is still nascent but booming—and Scent Library is determined to play a defining role in its future.

Global Beauty Giants Bet on Chinese Perfumery

It’s not just Chinese consumers taking notice of these niche perfume gems—global beauty conglomerates have entered the chat. In recent years, industry giants like L’Oréal, Estée Lauder, and Puig have made strategic moves to invest in China’s rapidly growing fragrance scene. This flurry of deals marks more than a passing trend—it signals a crucial shift: global beauty is officially betting big on Chinese perfumery.

Each partnership serves a distinct strategic purpose. For Puig, teaming up with Scent Library offered access to the mass-tier segment and a robust distribution network in China—an edge for a house traditionally known for high-end European perfumery. L’Oréal’s stakes in Documents and To Summer provided entry into the ultra-niche and home fragrance categories, aligning well with its expanding luxury portfolio (which includes Aesop, YSL, and Armani). Meanwhile, Estée Lauder’s investment in Melt Season is a calculated hedge against its softening prestige cosmetics segment, tapping into a high-margin, artisanal fragrance space with strong growth potential.

There’s also a defensive logic at play: by backing the most promising local players early, multinationals ensure these rising stars partner with them—not a competitor. It's not just about capital; it's about influence, access, and future-proofing market share. These deals let the incumbents shape brand trajectories—or acquire them outright—before they become serious competition.

For the Chinese brands, the benefits are just as tangible. Fresh capital fuels expansion—new boutiques, talent acquisition, and supply chain upgrades—while corporate expertise and global distribution networks accelerate international ambitions. To Summer, for instance, explicitly welcomed L’Oréal’s century of global beauty know-how to help bring “Eastern elegance” to the world stage. Melt Season leveraged Estée Lauder’s prestige to launch duty-free pop-ups in Hong Kong, marking its first step into overseas markets. Documents, backed by Ushopal and L’Oréal, is also preparing for international rollout. In essence, these partnerships are fast-tracking Chinese niche brands onto the world stage.

Thank you for a great detailed overview! Can't wait to try one of these brands and to visit their stores. Interesting that L'Oréal is letting them time to grow locally and hasn't expanded their distribution yet.